Investors receive hundreds of startup pitches, but only a few stand out. One of the first things investors evaluate is the problem being solved. A strong startup addresses a real, scalable problem with a clear value proposition.

The founding team is equally important. Investors often say they invest in people before products. A committed, skilled, and adaptable team increases confidence, especially in early-stage startups where pivots are common.

Another critical factor is market size and growth potential. Investors look for startups operating in large or rapidly growing markets. Even a great product may fail to attract funding if the market opportunity is limited.

Traction and validation play a key role. Metrics such as user growth, revenue, retention, or pilot customers indicate whether the idea works in the real world. Data-backed progress always strengthens investor confidence.

Finally, investors evaluate execution capability—how efficiently the startup uses resources and plans for growth. Clear vision, realistic milestones, and strong fundamentals make a startup investable.

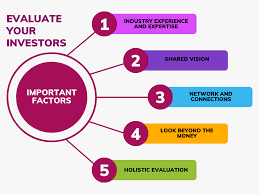

How Investors Evaluate Startups — What Really Matters

Understanding how investors think can dramatically improve your chances of funding. This blog explains the key factors investors consider before investing in a startup.

8 people saw this

0 comments

Be the first to comment on this article!